5 things homebuyers need to know about the ‘Big Beautiful Bill’

Overhauling healthcare, reshaping tax policy, boosting spend on border security — the newly passed "Big Beautiful Bill," which touches nearly every corner of American life, is making headlines across the country, and the housing industry is no exception.

Why it matters: For homebuyers and homeowners, along with the entire real estate and home construction sector, the mega-bill has some implications to note. They span everything from sweeping changes to tax deductions, mortgage-related benefits, and housing supply initiatives.

NewHomeSource takes a look at five things homebuyers need to know about the nearly 900-page omnibus bill and how it'll affect their homebuying and homeownership journey.

NewHomeSource

1. Mortgage Interest Tax Deductions are Here to Stay — Up to a Cap

Good for: First-time buyers, especially those using FHA/VA/USDA loans or putting down less than 20%.

Reality check: The cap remains at $750,000 — not a huge shift. This helps middle-income buyers more than low- or high-income groups.

For homebuyers who put down less than 20% and need to pay mortgage insurance, there's good news: The Big Beautiful Bill makes the mortgage insurance deduction permanent so you can keep writing off mortgage insurance on your taxes.

This deduction used to expire regularly, relying on Congress to renew it. Under the BBB, this tax break is here to stay. The limit was supposed to go back up to $1 million in 2026, but the bill has made it a permanent fixture, capped at $750,000. This isn't ideal for homebuyers purchasing homes above that threshold, but the stability in this tax break helps with long-term budgeting and financial planning.

It also extends to government-backed equivalents of PMI — think FHA mortgage insurance premiums, VA loans funding fees, and USDA guarantee fees.

2. SALT Cap Raises to $40k

Good for: Affluent buyers in high-tax states (e.g., NY, CA, NJ).

Reality check: Helps wealthier buyers stretch into more expensive homes, but offers no benefit for renters or most first-time buyers, and could exacerbate housing inequality.

SALT stands for State and Local Taxes. Previously, you could only deduct up to $10,000 of those taxes on your federal return, but that’s about to change.

For homebuyers and homeowners, SALT deductions quadruple from the current cap to $40,000. After five years, the tax deduction returns to $10,000 unless it's renegotiated.

This could mean savings in the range of thousands of dollars in annual property taxes, especially for homeowners living in high-tax states such as New York, New Jersey, California, and Connecticut. Housing experts suggest this BBB feature may even create a real estate boom, encouraging homeownership in affluent neighborhoods with higher property taxes.

3. Farewell to Energy Efficiency Incentives

This is a major loss for anyone wanting to buy or build an energy-efficient home.

Impacts:

- Higher costs for solar, insulation, and efficient HVAC

- Builders may stop offering green features

- Homeowners will miss out on savings over time

Affects:

- Environmentally conscious buyers

- Builders of net-zero or energy-efficient homes

- The broader push toward sustainability in housing

Longstanding incentives that helped homeowners improve their property's energy efficiency and save on their electricity, gas, and heating bills have been eliminated.

Across the board, the Trump administration is phasing out clean energy credits for new homes and energy efficient home improvement credits for existing ones. The Energy Efficient Home Improvement Tax Credit, for example, comes to an end this year. It provided a 30% credit — to a maximum of $3,200 per year — for spending on installing solar panels, geothermal heat pumps, and battery storage.

The same goes for energy-efficient home appliances. Credits of up to $5,000 for homes fitted with Energy Star-certified appliances expire at the end of 2025.

If you were thinking of buying a home with these environmentally-friendly features, keep in mind access to these credits end this December — with some fine print exceptions.

4. Support for Affordable Housing Developers

Good for: Renters, low-income households, and builders of affordable housing.

Reality check: This is a real, long-term benefit — but not immediate. It's a developer-side incentive, not direct support for homebuyers. And there is no guarantee that these homes will be owner-occupied.

While it doesn’t have direct effects on homebuyers, the BBB’s expansion of the Low-Income Housing Tax Credit and Permanent Zoning Opportunities will increase housing supply, especially in lower-income urban neighborhoods and in rural areas.

The LIHTC is a federal program that hands out tax incentives to developers who build affordable housing for low-income families. State housing agencies offset their income tax liabilities by committing to rent out a certain percentage of their units at below-market rates to those in the community who need housing most.

Under the BBB, that’s now being extended into 2029 with a boost from 9% to 12.5% in tax breaks. Developers willing to build in so-called “Difficult Development Areas” will receive a further bump in tax incentives. This move could lead to hundreds of thousands of new affordable homes being built over the coming years.

It's paired with an extension to "Opportunity Zones" where investors can collect further tax breaks, especially for building mixed-use and multi-family housing in rural and underserved areas.

These incentives will help reinforce affordable rental supply, relieving pressure on entry-level homebuyers and loosening up inventory pressures for homebuyers. For renters still saving up to buy a home, it’s a silver lining that may help them build up a down payment, too.

5. First-time Homebuyer Credits, Down Payment Grants Disappear

Good for: Service industry families, parents.

Reality check:

- Helps households marginally increase savings or qualify for loans, but does not replace targeted first-time buyer grants or down payment assistance — both of which are absent from the bill.

- There's no federal support for down payments — a huge hurdle for first-time buyers.

- Buyers must still rely on state/local programs, which are unevenly distributed and underfunded.

Notably absent are first-time homebuyer credits and down payment grants. The Big Beautiful Bill leaves these popular programs homebuyers often turn to in the hands of state housing finance agencies and local grants.

However, if you work in an industry based on a tipping culture or plenty of overtime, this income is now tax-deductible to the tune of up to $25,000 per year. This wasn't applicable before so this new tax-free income is "pretty generous" according to a spokesperson for the Tax Foundation.

For parents, the Child Tax Credit bumps up from $2,000 to $2,200 per child, and $1,700 is refundable in 2025. The BBB also introduces a new “Trump accounts” savings account, which is a one-time $1,000 deposit from the federal government for each child born between 2025 and 2028. Parents can then contribute another $5,000 per year, and the balance is invested in a diversified fund.

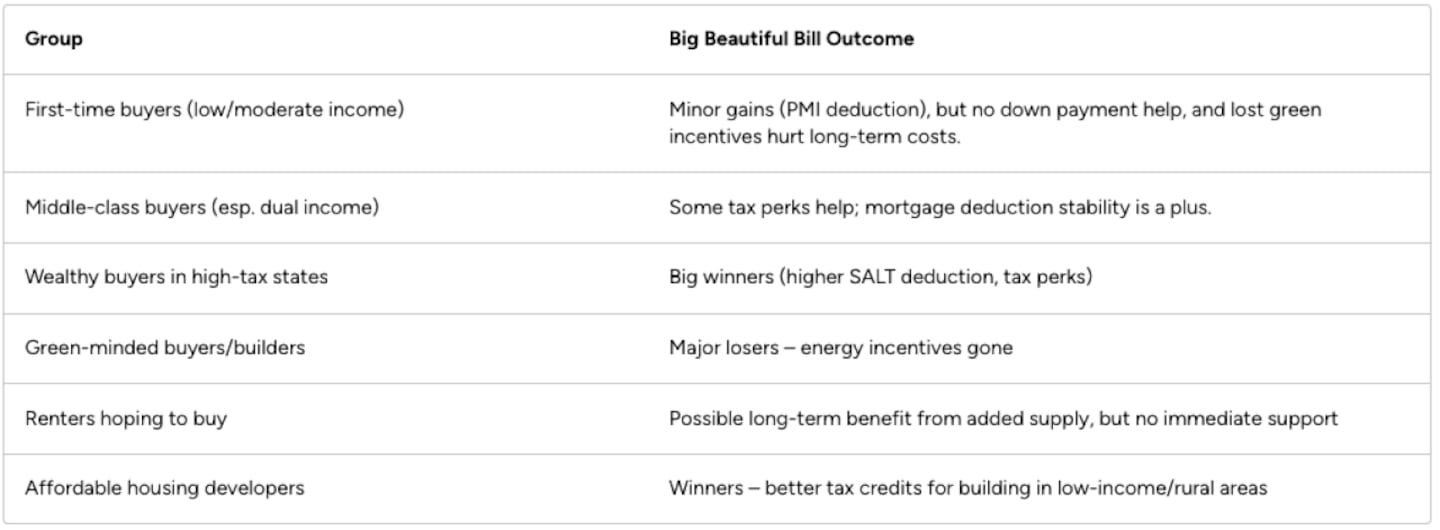

The Bottom Line

The Big Beautiful Bill may help some homebuyers — especially middle- and upper-income earners, tipped workers, and investors in high-tax areas. But it does little to directly support affordability or sustainability, and it eliminates programs that benefit first-time and energy-conscious buyers.

By favoring tax breaks for higher earners and phasing out green incentives, the bill:

- Widens the wealth gap in homeownership

- Encourages demand in higher-cost markets while ignoring affordability at the entry level

- Risks pushing prices up in already expensive regions

If you're building or buying a home in 2025:

- You may see short-term tax wins

- But expect fewer financial tools to make your home more energy-efficient or affordable

NewHomeSource is a website for homebuyers searching for new construction homes and communities.

This story was produced by NewHomeSource and reviewed and distributed by Stacker.